Introduction to Closing Costs in Texas

When buying a home in Texas, the down payment isn’t all you need to bring to the closing table. Closing costs are expenses that are due on the settlement day as well. These consist of several components that vary for the seller and buyer.

So, how much are closing costs in Texas? Read on to learn everything you need to know.

What Are Closing Costs?

Closing costs in Texas, also called settlement costs, are a set of final expenses that are paid for completing a real estate transaction. In the Lone Star State, real estate transactions are usually closed by escrow agents and title companies.

Some closing costs are negotiable, while others are non-negotiable, such as the taxes charged by your state or local jurisdiction.

Who Pays Closing Costs in Texas?

In Texas, both the buyer and seller pay certain closing costs at the end of the real estate transaction. The seller pays most of the real estate commission. Other fees, such as documentation charges and transfer fees, are paid by the buyer.

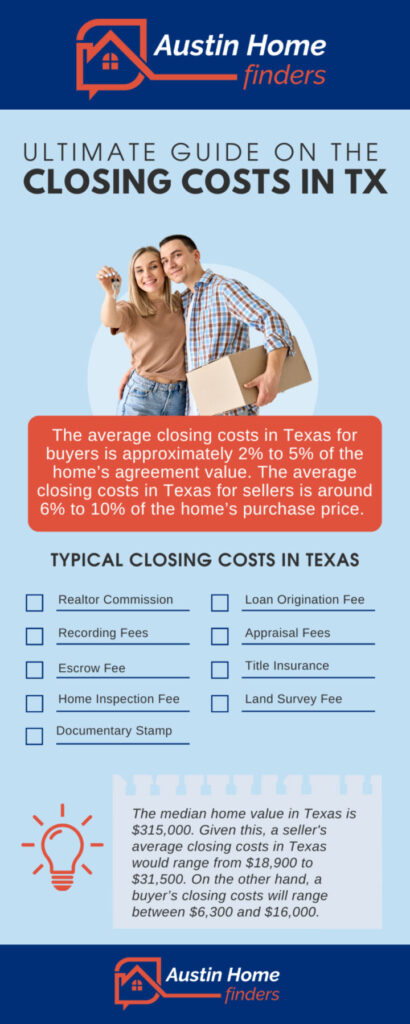

The average closing costs in Texas for buyers is approximately 2% to 5% of the home’s agreement value. The average closing costs in Texas for sellers is around 6% to 10% of the home’s purchase price.

The median home value in Texas is $315,000. Given this, the average closing costs in Texas for a seller would range from $18,900 to $31,500. On the other hand, a buyer’s closing costs will range between $6,300 and $16,000.

Below, you’ll see a range of closing costs for both the buyer and the seller based on varying home prices.

Buyer Closing Costs

| Home Purchase Price | Buyer’s Closing Cost (2% to 5%) | Total Upfront Cost (With 20% Down Payment) |

|---|---|---|

| $157,500.00 | $3,701.25 to $7,875.00 | $35,201.25 to $39,375.00 |

| $236,250.00 | $5,551.88 to $11,812.50 | $52,801.88 to $59,062.50 |

| $315,000.00 | $7,402.50 to $15,750.00 | $70,402.50 to $78,750.00 |

| $472,500.00 | $11,103.75 to $23,625.00 | $105,603.75 to $118,125.00 |

| $630,000.00 | $14,805.00 to $31,500.00 | $140,805.00 to $157,500.00 |

Seller Closing Costs

| Home Purchase Price | Seller’s Closing Cost (6% to 10%) |

|---|---|

| $157,500.00 | $9,450.00 to $15,750.00 |

| $236,250.00 | $14,175.00 to $23,625.00 |

| $315,000.00 | $18,900.00 to $31,500.00 |

| $472,500.00 | $28,350.00 to $47,250.00 |

| $630,000.00 | $37,800.00 to $63,000.00 |

Typical Closing Costs in Texas

In Texas, the buyer and the seller are responsible for specific closing costs to transfer the house ownership to the buyer legally. These costs include fees and charges that need to be paid over and above the net price of the property.

Typical Seller Closing Costs in Texas

Realtor Commission

The real estate agent’s commission is approximately 5% to 6% of the agreement value.

Recording Fees

This is charged by the local government for registering or recording the purchase or sale of a piece of real estate. In Texas, the fee ranges from $600 to $700, varying from county to county.

Escrow Fee

This fee is charged by an escrow agent, an unbiased party that carries out the property transactions between the buyer and the seller.

Home Inspection Fee

A home inspection is a safety and quality assessment on the property for sale. This can be done prior to listing the property on the market or just before the closing. Home inspection fees in Texas are usually around $400 to $600.

Documentary Stamp Taxes

Documentary stamp taxes, also referred to as transfer taxes or deed taxes, are levied by a state or local government to transfer the title of a property from the seller to the buyer. This tax is typically based on the property’s sale price.

Typical Buyer Closing Costs in Texas

Loan Origination Fee

A loan origination fee covers the cost of services rendered by a mortgage lender to set up your loan. In Texas, this fee is calculated as 1% of the mortgage loan amount.

Appraisal Fees

The appraisal fees are paid to the professional appraiser who evaluates the value of the property and ensures that the buyer gets the best competitive price. This cost ranges from $300 to $500.

Title Insurance

Title insurance protects against loss due to outstanding taxes, unpaid dues, default in the title, or any violation belonging to any previous owners. In Texas, title insurance can cost around $200 to $250.

Land Survey Fee

Only the states of Texas and Florida require buyers to conduct a land survey when buying a house. All the other states do not include land surveys in their closing costs. The minimum charge is $250 and can go up further depending on the size of the land.

Refinancing and Closing Costs

Refinancing closing costs are the sum of all the expenses paid against services that were used in the process of underwriting and closing on the mortgage loan. This ranges from 3% to 5% of the mortgage amount.

Closing Cost Assistance Programs in Texas

Texas homebuyers looking for assistance programs with their closing costs may be eligible for the following:

My First Texas Home

My First Texas Home is an ideal option for first-time home buyers. The program provides a 30-year fixed-rate loan with good interest rates and forgiving credit terms. The maximum loan amount is 5% of the home’s value.

My Choice Texas Home

Like My First Texas Home, My Choice Texas Home offers low-interest mortgages and up to 5% assistance with closing costs and down payment. The program also allows for conventional loans alongside government-backed options like FHA and VA loans.

Homes for Texas Heroes

Homes for Texas Heroes is a program that honors the service of teachers, firefighters, police officers, nurses, and EMS personnel by offering closing costs and downpayment assistance of up to 5% at competitive interest rates and flexible eligibility requirements.

Conclusion

The closing costs in Texas are mandatory expenses that both the seller and the buyer should pay over and above the mortgage loan amount.

If you need assistance with closing costs, I can help! Please don’t hesitate to contact me at 512-779-6745 or joeschleis@realtyaustin.com to schedule an appointment.

Frequently Asked Questions

How are closing costs calculated?

Closing costs include several fees and charges that are calculated based on the actual expenses for both the buyer and the seller, which vary depending on the location of the property as well as the agreement made between the buyer and the seller. It is best to consult with a real estate professional for the appropriate guidance.

Can closing costs be included in the loan?

Yes, closing costs can be included in a mortgage loan. This is also known as “rolling” closing costs into a loan. However, since you will be paying interest on the closing fees as well, you’ll be paying more for your mortgage in the long run.

Do sellers pay closing costs in Texas?

Yes, both the buyer and the seller pay closing costs in Texas.